Compare the Best (Top 10) Business Credit Cards

A business credit card is one of the simpler ways to get access to short-term funding to grow your business.

71% of Australian small business owners use credit cards.

What is a business credit card?

The 2 Types of Business Credit Cards

Low-cost business credit cards

Rewards business card

In addition you may also be offered a “Charge Card”.

Charge cards are NOT actually credit cards, because there are no interest payments and there is no ongoing credit facility attached to them. However, you can use them in much the same way to make purchases in stores and online. The main difference with a charge card is that you are required to pay off the full balance every month, and you’ll be charged a fee if you fail to do so.

Features of business credit cards

Low or zero annual fees

Meaning that you pay little or no fees for your facility, and the lender makes all their money from your interest payments and any additional charges you incur, such as late payment fees.

0% interest rate periods

These are a valuable enticement, especially for a start-up, giving you a period ranging from weeks to months where you can spend money on your card without paying any interest at all. Cash advances (where you use your card to get money from an ATM or transfer money to another account) are usually excluded from any 0% interest offer.

0% balance transfers

The aim of these offers is to get customers to switch lenders, by allowing you to pay off an existing facility and transfer your balance to a new credit card. If you’ve passed your interest-free period on your existing card and are paying high interest on your balance this can be an appealing option – provided that you don’t end up paying an even higher rate once the new interest-free period ends!

Low interest rates

On business credit cards vary widely, from as low as around 10% to more than 20%. Different rates usually apply to different types of spending (balance transfers, purchases, cash advances) so make sure you know what all those rates are before you make a decision. Credit cards with lower rates may come with higher annual fees and charges to offset the lenders’ risk, so be sure to check out those too. You’ll find more on how to compare business credit cards later in this article).

Low cash advance rate

Cash advances (where you withdraw cash from an ATM or transfer it to another account) usually attract the highest interest rates (and sometimes additional fees), and are excluded from most interest-free period offers. Low cash advance rates can make it less expensive to extract cash from your credit card, but if access to cash is a major concern it’s likely to be more cost-effective to arrange, say, an overdraft facility for your business, rather than a credit card with a low cash advance rate.

Interest-free days

Most cards offer an interest-free period of around 45 – 55 days on purchases. However, this only applies if you pay off the full balance on your credit card when it falls due at the end of the period, so it may not be as valuable as it sounds.

Rewards

Just like personal credit cards, many business credit cards offer rewards programs, where you earn points for each dollar you spend on the card. You can then spend those points in a variety of ways, depending on the program, and the value of each point can vary according to which partner company you spend them with. We will cover which type of business credit card rewards are right for your business in the next section.

Cashback offers

Some cards offer rewards in the form of cashback on certain types of purchases. This is effectively a discount on your purchase, which can be very beneficial – but be aware that you may need to proactively apply for each cash refund, which can be time-consuming and is easy to overlook when you’re busy running your business.

Frequent flyer points

Again like personal credit cards, many business credit cards can be linked with a frequent flyer account, earning airline points instead of reward points for each dollar you spend. This can be useful if your business spends a lot on travel – or as an incentive for individual employees if you decide to let them credit the points to their personal frequent flyer accounts.

We asked Keith Mason, the Founder of Point Hacks to recommend his Top 5 tips for you, here’s what Keith had to say…

Know what you want to do with your points

If you don’t know how you’re likely to want to use your points, then it will be hard to choose a business credit card or loyalty program that achieves those goals.

If you’re not sure yet, here are some ideas – with the right business frequent flyer credit card you could reward your staff with points or travel, or alternatively save on business travel expenses. If you’d prefer to pocket the benefits of rewards points from your business spend yourself, then think about how and where you want to travel.

Get to know the strengths and weaknesses of your preferred rewards program

Different frequent flyer and rewards programs have different advantages. Without digging a little deeper into the mechanics of the various programs, it’s going to be hard to make an informed choice about the right card to meet those goals we mentioned above.

Research the benefits of the business rewards credit cards that are linked to your preferred points currencies

Some credit cards are linked directly to frequent flyer programs like Qantas Frequent Flyer or Velocity. Others are linked through their own bank rewards program, with a range of frequent flyer programs as transfer partners for their points (at Point Hacks we like to call these ‘flexible points programs’).

Each option has strengths and weaknesses – simplicity, in the case of ‘direct earn’ cards, and flexibility, in the case of ‘flexible points programs’. Try and pick an option that suits you and figure out the cards on offer which meet your business’ preferences.

Make sure you know your points earn rates, caps and fees

Many credit cards offer different earn rates for different types of spending, and cap the number of points you can earn across each month or year. Try and pick a card which best suits your business’ spend patterns and has an affordable annual fee in order to earn the most points without overpaying – whether that’s a card you already have in your wallet, or a new one that suits your needs better.

Learn how to use your points effectively

All these points you earn from your business’ spend are worthless without actually using them. By learning more about how to best use your points with all the various airline and frequent flyer programs that have links to your credit card, you can get the most value from them.

The key to using your business credit card successfully is to never forget it’s a short-term option. Your lender will usually have the right to withdraw your credit facility at any time, for any reason, which is why you should never use it to finance the purchase of long-term assets (not to mention the extremely high interest charges you’ll incur if you carry a large balance on your credit card). If you need to make capital purchases, it’s vital that you organise separate finance that will allow you to spread your repayments over the lifetime of the asset, so that you won’t risk being left in the lurch because your lender decides to withdraw credit.

So what should you use your business credit card for?

Basically, the day-to-day expenses of your business, like consumables, office supplies and travel. You can also use it for expenses like utility bills, helping you to keep on top of your obligations if your cash flow is suffering during a quiet sales period. To avoid hefty interest charges, it’s important to repay the balance on your card as quickly as possible. With many cards you’ll be given an interest-free period on your purchases, so you can avoid paying interest altogether if you pay off your balance in full at the end of that period. Remember that credit card interest rates are generally between 10% and 20% (and sometimes even higher), while the interest you earn on any cash you have in a bank account probably be less than 4% – so it makes much more sense to pay off your credit card balance than to have cash sitting around in the bank if you don’t need it. Having said that, there are some expenses you won’t be able to pay by credit card – or that will incur a fee if you choose to pay that way – so it’s useful to have at least some real cash available. Drawing cash from an ATM or transferring cash from your credit account into another account is known as a ‘cash advance’, and will almost always incur both fees and instant interest, often at a higher rate than you’ll pay on purchases, so it’s best avoided.

Business credit card interest rates and fees

As with personal credit cards, interest rates on business credit cards vary from bank to bank and card to card. Most lenders offer a range of business credit cards aimed at different types of business, and some of these cards have specific eligibility criteria, such as minimum turnover. When it comes to choosing which card to apply for, interest rates are not the only costs you have to consider. Most cards have an application or an annual fee, and some may charge extra fees for additional cards, late payments etc. – although these fees may be tax deductible as a business expense. Be sure you’re informed about all the fees and charges before you decide. On the flip side, many cards offer spending rewards which can be a valuable incentive if you use the card frequently enough – plus a range of other perks such as fraud cover, travel insurance, VIP access to airport facilities, and ‘concierge’ services that can help with anything from travel and event bookings to assistance in an emergency. Be aware, though, that the more attractive those perks seem, the more you’ll probably pay for them in annual fees and higher interest rates! If you opt for a ‘no frills’ low-rate card which offers none of these extras, your credit card facility is likely to be considerably cheaper.

| Company | Purchase Rate | Annual Fee | Interest Free Days | ||

|---|---|---|---|---|---|

|

Bank of Melbourne

Business Vantage Visa |

9.99% |

$55 |

55 days |

More Info |

|

BankSA

Business Visa |

9.99% |

$55 |

55 days |

More Info |

Bankwest

Bus Mastercard Low Rate |

11.99% |

$99$0 in first year |

55 days |

More Info | |

|

newcastle permanent

Business Visa |

11.99% |

$55 |

44 days |

More Info |

|

St.George

Business Vantage Visa |

9.99% |

$55 |

44 days |

More Info |

ANZ

Business Low Rate |

12.99% |

$100 |

0 days |

||

|

Commonwealth Bank

Business Low Rate Credit Card |

14.55% |

$0 |

0 days |

|

|

NAB

Low Rate Business Card |

0%for 12 mths then 13.25% |

$60$0 in first year |

45 days |

|

|

Westpac

Business Choice Everyday Visa Card |

14.25% |

$0$75 waived due to spend |

55 days |

|

|

ANZ

Business 55 Interest Free Days |

17.74% |

$150$0 in first year |

45 days |

How is a business credit card

different to a personal credit card?

A business credit card is issued to your business, not to you as an individual, and must be used for business expenses. This enables you to separate your business spending from your personal spending for accounting and tax purposes – and if your business is a partnership, trust or incorporated company (i.e. if you’re not a sole trader) the liability for your credit card debt will lie with the business, not with you personally. In essence, business and personal credit cards are extremely similar. Both can be used to make purchases online or in retail stores, and interest is calculated in the same way. But business credit cards often have additional features, such as the ability to apply different spending restrictions to different cards linked to the same facility (so you can control and monitor the way your employees use them). They may also offer detailed reporting and analytics tools to help you track spending. Business credit cards tend to offer business-focused reward programs, where you can redeem the points you earn by spending on your card for business travel, or in stores that sell business merchandise such as office supplies.

How do you compare business credit cards?

Choosing a business credit card is a complex business that involves much more than simply comparing interest rates. Even if you’re only comparing the costs of different facilities, you need to look at all the fees and charges you may incur through using each card, including:

- Interest rate on purchases

- Interest rate on balance transfers

- Interest rate on cash advances

- Annual fees

- Late payment penalties

- Administration charges

Depending on how you plan to use the card it may, for example, be more cost-effective to pay a higher annual fee to get a lower interest rate on purchases – but it’s important that you find out exactly what you’ll be paying before you make any decisions. To complicate things further, there are several other issues to consider which can have a big impact on the overall cost of your facility.

Any initial interest-free period

Number of interest-free days on purchases

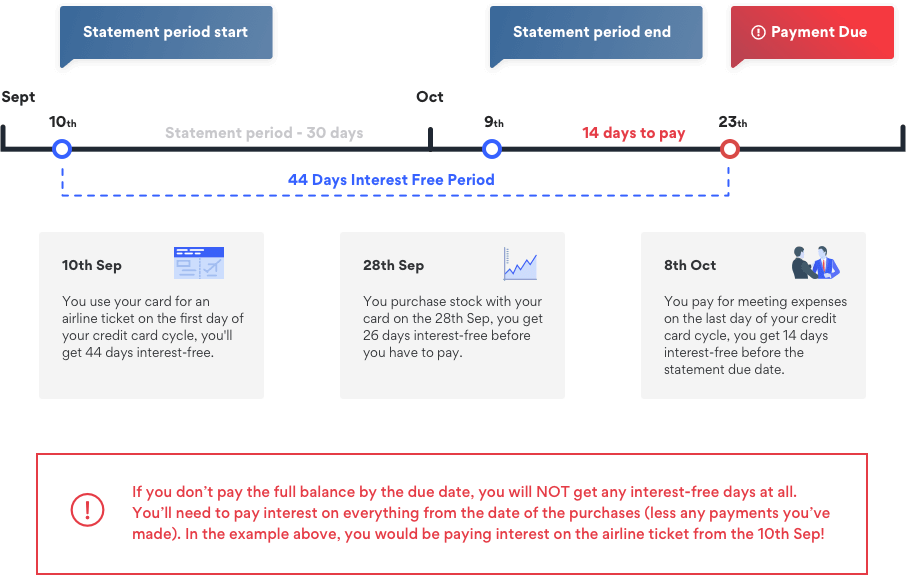

This concept can be very misleading though, because it doesn’t mean you get that number of days after each individual purchase.

What actually happens is that each month you will receive a statement showing your total credit balance, and you’ll have a ‘grace’ period of, for example, 14 days from the date of the statement to pay it off in full.

The grace period (e.g. 14 days), plus the days in the billing cycle when you made the purchase (e.g. 30 days), together make up the interest-free period (e.g. 44 days). So, in this example, if you buy something on the last day before the end of your billing cycle, you’ll actually only get 15 interest-free days on that purchase.

It’s very important to note that the interest-free period only applies if you pay off the full balance shown on your statement by the end of the grace period. If you don’t, you’ll be charged interest on the unpaid balance from the date of each purchase, not from the end of the interest-free period.

When weighing up your options, the value of the interest-free period to your business will really depend on how you expect to use your card. Obviously, the more interest-free days you have, the longer you can have that cash at your disposal, which can be valuable if cashflow is tight.

But if you aren’t expecting to pay off your full credit card balance each month, interest-free days are likely to be much less important to you than a low interest rate on purchases.

Rewards and perks

Beware though – credit card companies are in this to make money, and the rewards won’t begin to outweigh the cost of the facility if you end up paying regular interest, or if you don’t use the card frequently enough.

Cards with rewards usually come with substantially higher fees and interest rates than the no-frills low-cost variety. Make sure you run the numbers to find out how much you’ll need to spend on the card before you’ll earn enough rewards to recoup the annual fee – and how much more you’d need to use it to outweigh the value of having, say, more interest free days or a lower interest rate on a card with less perks.

Pro Tip 1: Once you’ve worked out the true cost and value of each type of card so you can compare them properly, the decision then comes down the way you plan to use your facility help you grow your business and manage your cashflow. Pick the card that best suits your financial strategy.

Business credit cards for Startups

The truth is that your startup funding options are likely to be limited. Without an established trading record, financials and a credit rating, your business won’t qualify for a credit card in its own right, so the lender is likely to assess your personal creditworthiness before deciding whether to offer you a facility. The better your credit rating, the more likely you are to be approved for a business credit card, and the higher the spending limit you’re likely to be offered. Some types of business credit card have specific eligibility criteria – such as an established minimum turnover – which will obviously exclude start-up businesses. The good news is that other cards are specifically designed for start-ups, such as the Visa card attached to ANZ’s start-up package. As a start-up, cashflow is likely to be a big focus for your business, so you’ll need to look for a card with features that let you hang on to your cash for as long as possible before repaying your credit balance, such as those attractive introductory 0% interest periods. There’s a good chance you won’t be able to pay off your full credit balance each month while you’re in the start-up phase (and may not yet be making reliable profits), so it may also be wise to choose a card with a low interest rate on purchases (less than 15%) rather than focusing on interest-free days or low annual fees. Likewise, you may not have the cash available in the early days to get real value out of rewards programs, so a basic low-rate card is probably a more cost-effective option for a start-up.

Which are the best business credit cards?

The best card for your business will depend on a number of factors, including:

- How, and how often, you plan to use the card

- Whether you expect to repay the balance each month

- Whether rewards like frequent flyer points will be of any value to your business.

What’s more, the choice of cards available to you will vary according to the size and history of your business, or your personal credit rating. On top of that, the business credit card market is highly competitive, with new deals being offered regularly, and fees and interest rates constantly fluctuating.

Which business credit cards offer the best rewards?

The value of credit card rewards all comes down to how much you spend on your card. Since rewards cards usually have higher interest rates and annual fees that the low-cost varieties, you’ll have to spend quite a bit just to earn enough rewards to offset those higher charges. Evaluating rewards is a tricky business, because it’s not just a matter of comparing the number of points or frequent flyer points you earn per dollar spent. Each rewards program will have a complex set of rules and partner relationships governing how those rewards can be used – and the value of points can vary depending on how you spend them (on flights or upgrades, in selected partner stores, buying merchandise from the rewards catalogue etc.) Canstar’s ratings can be a useful starting place when it comes to choosing a credit card for your business.

Will I have to personally guarantee

my business credit card?

This will depend on the type of business card you apply for, and whether you or your business will be taking responsibility for the credit facility. If you are a sole trader, or your business does not meet the lender’s criteria for business facilities (for example, you don’t have two years’ financials available), you may only be able to get a facility with personal liability. This will still enable you to separate the administration of your business and personal finances, but it will mean that the buck stops with you, personally, if your business fails to meet its repayment obligations on the business credit card. Your personal assets could be at risk. However, if you have an established business that is operated by a partnership, trust or incorporated company, you can apply for that business to have liability for the credit card facility. If a facility is offered on this basis, the responsibility for repayments will lie with the business, not you personally, and your private assets will not be at risk. Likewise, any late payments will affect the credit rating of your business, not your personal rating.

How do I apply for a business credit card?

To apply for any business credit card, you’ll need to meet the lender’s eligibility criteria, which will probably include;

- Having a valid Australian Business Number (ABN)

- Australian residency

- Australian bank accounts

- Proving your ability to repay (as a business or individual)

– Bas Statements, Tax Returns, or connecting your accounting software - Credit rating check

Each lender will have their own application process, but most will allow you to apply online. You can expect to be asked for supporting information with your application, ranging from identifying documents and contact details to financial information about your business. If you are taking personal responsibility for the credit account, you can expect to be asked for these additional documents;

- Pay slips

- Individual tax returns

- ccountant’s details

If you don’t wish to apply online, you can make an appointment to meet with a business lending specialist at your bank and complete the paperwork in person.

How long will my business credit card

application take?

If you’re well prepared and have electronic copies of all your supporting documents available on the spot, filling out a business credit card application form should be a quick process. And with an online application, you’ll usually get an instant response. If you apply in person, it may take a day or two for your application to be assessed – your lender will confirm how long you can expect to wait when you submit your paperwork.