Equipment finance for manufacturing businesses

Setting up a manufacturing business requires a major outlay on specialist equipment before you can begin production. As your business expands you may need to purchase more plant and machinery to increase your capacity, or to keep up with your competitors as technology advances and best practice evolves.

For high value manufacturing equipment with a medium or long lifespan, a chattel mortgage or finance lease may be the most suitable option. These forms of equipment finance will both allow you to take possession of your equipment without a heavy up-front investment, so you’ll have cash available for ongoing costs like raw materials and labour. In both cases, you’ll need to record the asset and the finance liability on your balance sheet.

- With a chattel mortgage you’ll own the asset immediately but spread the cost over an agreed period (typically up to five years). However, the equipment will be used as security for the loan, so you won’t be able to dispose of it without the lender’s approval until the loan period ends.Depending on the lender, your repayments may be based on a fixed or variable interest rate. You may pay off the loan and principal in equal instalments, or make lower regular payments and pay a residual balloon payment at the end of the lease.Generally, you will be locked into the loan for the full period, with hefty fees for early termination. However, you will generally be able to negotiate repayment terms based on your cash flow.

- With a finance lease, the lender will purchase the manufacturing equipment on your behalf and then lease it to you in exchange for a regular fixed rental payment. The lease period is usually close to the full expected lifespan of the asset, which means you can spread the cost and have complete certainty over your budgeting.While you will not own the asset, you will have all the risks and benefits of ownership. That means that you will be responsible for maintenance and repairs.At the end of the lease period you will generally have a range of options – buy the asset for an agreed price, return it to the lender, or lease it for another period, usually for a very low ‘peppercorn’ rent.

Equipment finance for restaurants

As a restaurant owner you’ll have a wide range of equipment and fit-out costs to cover. Setting up your commercial kitchen and dining area will be a substantial investment, and equipment finance can help you spread the cost, freeing up your working capital for variable costs such as ingredients, breakables and wages.

- A chattel loan may be the most suitable option for your dining area fit-out. Generally, you’ll be able to agree a loan period of up to five years, and a flexible repayment schedule tied to your anticipated income (especially if your cash flow is highly seasonal because of your location or type of cuisine). You may also be able to fix your interest rate for budgeting certainty.

- Most commercial cooking and restaurant equipment will have a medium-term lifespan and may be ideal for a hire-purchase arrangement, where the financer will purchase the equipment on your behalf and then sell it to you in fixed instalments over an agreed period. At the end of the contract the equipment will be yours, to use or sell.Some specialist providers of restaurant finance offer flexible options which are a hybrid of a hire purchase and operating lease product – giving you the option to rent initially, and then either return your equipment, buy it outright, continue renting, or convert to a hire-purchase contract where you’ll own the equipment at the end of the contract.

- Meanwhile for your IT, telecoms equipment and payment systems, an operating lease may be the best solution, allowing you to upgrade as newer technology becomes available.

Equipment finance for medical practices

As a medical, dental or veterinary practice, you need top-quality equipment in peak condition – but each piece of equipment represents a substantial investment. Equipment finance allows you to set up your practice and keep up to date with changes in best practice without taking a massive hit to your working capital.

Meanwhile, it’s vital that you have free cash available for your hefty operating expenses, especially staff costs, consumables and insurances.

There are specialist providers of medical equipment finance, who will help you finance everything from your practice fit-out, telecoms and IT equipment, to the delicate specialised machinery you use to treat your patients. You can arrange finance for a specific piece of equipment, or an ongoing facility that lets you purchase and upgrade equipment over time, as you need to.

You can expect to use several types of asset finance in your practice:

- Operating leases for the IT and telecoms equipment you need to run your practice efficiently, and for high-tech equipment that may quickly become obsolete.

- Hire purchase agreements for equipment with a medium-term lifespan, or for items like office and waiting room furniture.

- Chattel mortgages for your practice fit-out, and for larger pieces of equipment with a longer lifespan and low risk of obsolescence.

Equipment finance for retail businesses

As the owner of a retail business, your main upfront cost is likely to be your store fit-out. First impressions are crucial, but custom shelving, premium fittings and interior decoration can be a substantial investment.

Meanwhile, you need enough free cash flow to keep your store stocked and cover ongoing costs such as wages, tax and insurance.

- For your initial fit-out and later upgrades, a chattel loan may be the most suitable option, allowing you to spread the cost over an agreed loan period (typically up to five years).Lenders understand that most retail businesses are seasonal and will generally allow you to fix a repayment schedule that is tied to your anticipated cash flow.You may be able to fix the interest rate on your loan, so you’ll know exactly how much your repayments will be. Your regular payments will be lower if you opt to pay a final balloon payment, but that does mean you’ll pay more interest in total over the term of the loan.

- For your IT, telecoms equipment and payment systems, an operating lease may be the best solution, allowing you to upgrade as newer technology becomes available.

Equipment finance for construction/mining businesses

If you operate in the mining or construction industry, you will can expect to pay hundreds of thousands of dollars for each heavy vehicle or piece of specialised equipment.

While these sums may exceed the loan limit for some equipment finance providers, there are others who specialise in providing finance to businesses in the mining, construction and earthmoving sectors.

These providers offer a full range of equipment finance products, including chattel mortgages, operating and finance leases and hire purchase. However, for high-value, heavy equipment, the most common financing choice is a chattel mortgage, where the asset is used as security for the loan.

With a heavy equipment chattel loan, you will generally be able to agree a term of up to seven years, and negotiate a flexible repayment schedule to suit your cash flow.

You’ll usually have the option of equal repayments across the full term of the loan, or to pay lower monthly amounts and a residual balloon payment at the end of the contract. (Note that the balloon payment option will mean you pay more interest in total).

You can usually also choose whether to pay a deposit (in cash, or by trading in another vehicle or piece of equipment) or to borrow the full cost of the asset.

Equipment finance for tradespeople

As a tradesperson, your tools and vehicles are the essence of your business. To deliver high quality work, you need quality equipment in peak condition, which means both up-front and ongoing investment in tools.

For lower-value, everyday tools that may need to be replaced regularly, some hardware chains offer trade accounts with short-term credit options.

For high-value power tools and other expensive pieces of equipment, you may opt for an asset loan or lease arrangement, depending on whether you wish to own the equipment from the outset, or have the option to return it and upgrade at the end of the period.

When it comes to your work vehicles, the finance market is highly competitive. Most dealers have their own finance company, and vehicle loans are commonly offered by both banks and fintech lenders. You will be able to choose between:

- Vehicle finance (effectively a chattel mortgage) where you’ll take out a loan secured on the vehicle and repay it over an agreed period of time. You may be able to negotiate fixed or variable interest, and a repayment schedule to match your cash flow. The term is typically up to five years.

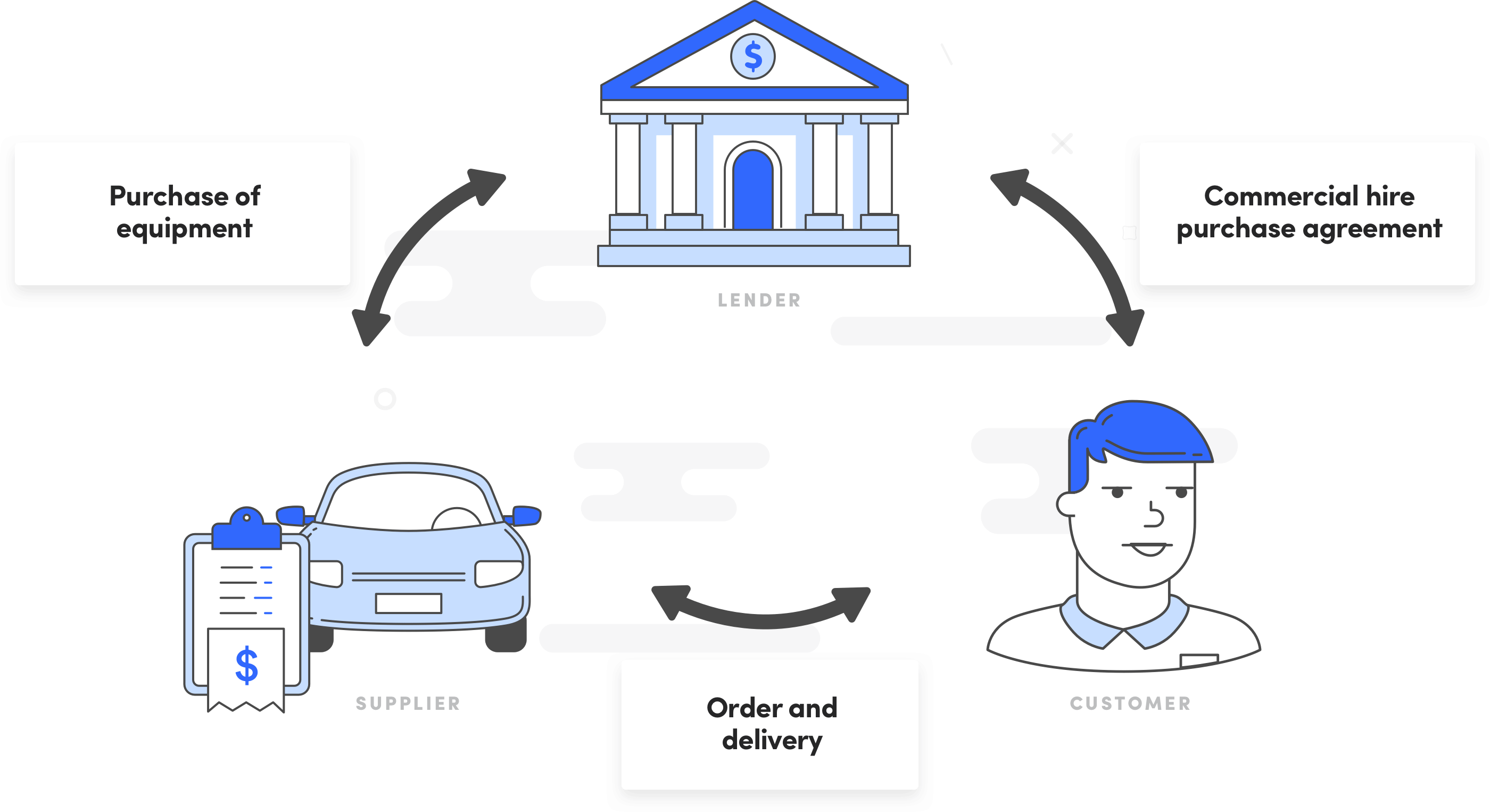

- Hire purchase, where you’ll pay regular fixed payments for an agreed period (again, typically three to five years) and will own the vehicle at the end of the loan term. You will have to pay a deposit and will usually pay off the balance of the loan in regular instalments.

- Leasing, where the finance company will buy the vehicle and lease it to you under either a finance or operating lease. At the end of the contract you’ll return the vehicle to the lender, or you may have the option to buy it under a finance lease.With an operating lease you may be able to take out a maintenance contract so that the lender will be responsible for servicing your vehicle – but be aware that they may impose mileage restrictions under an operating lease, which could restrict your ability to do business if you service customers across a wide area.